In the mission statement Neluns declares its ultimate goal to build the next generation financial ecosystem hinging on a bank and insurance company functionality. The bank side of the system will support operations with crypto and fiat currencies and will have a built-in currency exchange module. The system is likely to create the most favorable conditions for the further evolution and increased maturity of the cryptocurrency market.

Ecosystem Key features

The Neluns ecosystem includes:

- Neluns Bank is the next generation bank supporting most of the core retail bank features for fiat money and cryptocurrencies.

- Neluns Exchange is built on the cutting edge technology facilitating the improved accessibility of the secure and fast cryptocurrency trade operations.

- Neluns Insurance company insures all the transactions and trades within the ecosystem.

Users have access to the following functionality within the Neluns ecosystem:

- Trade cryptocurrencies with a few clicks

- Exchange cryptocurrencies

- Fast deposits and withdrawal to/from the system from around the globe

- Option to open an IBAN Account that supports multicurrency (private or corporate)

- Issue debit and credit cards from major card issuers Visa, MC, Amex

- Promptly send and receive international money transfers

- Earn more interest on your money in the Neluns savings accounts in fiat or cryptocurrencies

- Receive loans from Neluns in fiat and cryptocurrencies

- P2P (Peer-to-peer) Landing Platform allows earning interest on lending to other users

- Draw profits from the NLS tokens trading on the cryptocurrency exchanges

- Trades insurance is available and can be enabled for select or all transactions

- Get dividends

- Lowered risk levels and extra profits are open for the active market participants

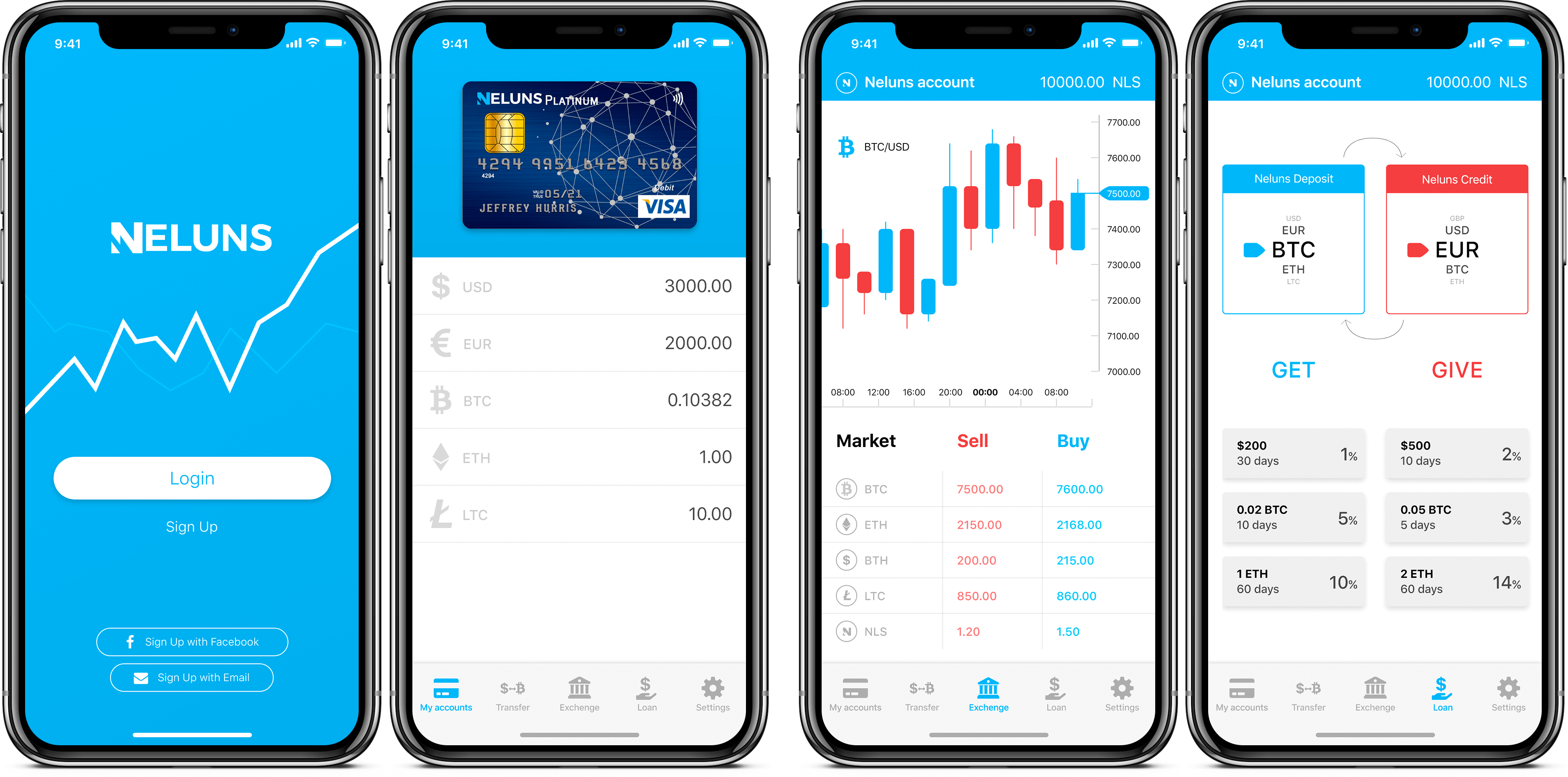

Neluns Bank offers a broad range of services to private and corporate customers. The transactions are executed in fiat and crypto money. Once a multicurrency account is open users are able to carry out transactions in USD, EUR, GBR and cryptocurrencies. There’s an option to issue a bank card for the multicurrency account.

There are 4 types of bank cards and respective software products available: Lite, Silver, Gold and Platinum.

Making purchases, sending payments, trading cryptocurrencies and fund withdrawals are available from any ATM around the globe 24x7.

Users can obtain loans in fiat or crypto money from the system as well as earn interest on the savings account in the system. All savings accounts are FDIC (The Federal Deposit Insurance Corporation) insured. The P2P fiat and cryptocurrency lending platform will be developed and it will serve as a base of Neluns Bank. Users will be able to extend and obtain loans to/from other users.

Neluns Exchange is based on the bank guarantee principles allowing us to create the new high quality cryptocurrency exchange. These principles combined with the cutting edge technology are the pillars of the system supporting easy fund withdrawals, cyber security threats protection, high availability and peak loads resistance. The system is expected to offer both best user experience for cryptocurrency traders and great deals on savings account interest rates.

There will be apps created for iOS and Android to make sure that the bank and exchange operations are available on the go from mobile devices. 24x7 technical support service will be launched to address any challenges users face.

The project will be run in accordance with respective government regulations and all applicable legal frameworks to minimize the risks and facilitate the successful project execution. Neluns Bank is in the process of obtaining a banking business license. Neluns Bank will adhere to all respective licensing, regulatory and supervisory requirements that are applicable for the regulated banks. Neluns Exchange will be regulated as per CFTC (U.S Commodity Futures Trading Commission) and SEC (U.S Securities and Exchange Commission) licensing requirements.

Main ICO Facts

NLS token is ERC20 token (public Ethereum blockchain). It is a security token with 50% dividends payout based on the Neluns ecosystem performance (the bank, the exchange, the insurance company).

Dividends are paid out on a quarterly basis.

Dividends payout formula is based of the number of tokens one holds vs. the total number of tokens.

NLS token holders who use the Neluns ecosystem products enjoy additional advantages. The more tokens are held the greater bonuses and privileges are provided.

- NLS Token supply – 200M

- Token price – $1

In 15 days after the first round of ICO starts Form D (an official notification of ICO start) will be submitted to SEC (U.S Securities and Exchange Commission).

ICO stages (rounds)

Pre-Sale

Hard Cap - $2.000.000

Soft Cap - $500.000

1 stage (round), pre-sale, stage (round) length 14 days, from 08-01-2018 to 08-15-2018.

bonus 30%

extra-bonus 40% investment of more than 1 ETH in one transaction

extra-bonus 50% investment of more than 10 ETH in one transaction

Pre-ICO

Hard Cap - $10.000.000

Soft Cap - $2.000.000

2 stage (round), pre-ICO, stage (round) length 21 days, from 08-15-2018 to 09-05-2018.

bonus 20%

extra-bonus 30% investment of more than 1 ETH in one transaction

extra-bonus 35% investment of more than 10 ETH in one transaction

ICO

Hard Cap - $112.000.000

Soft Cap - $10.000.000

3 stage (round), ICO, stage (round) length 31 days, from 09-05-2018 to 10-05-2018

bonus 10%

extra-bonus 20% investment of more than 1 ETH in one transaction

extra-bonus 25% investment of more than 10 ETH in one transaction

Projects Website: https://neluns.io/

E-mail: [email protected]