According to analysts Kazuki Miyamoto and Yoshiyuki Suimon, bitcoin could boost Japan’s Gross Domestic Product (GDP) by up to 0.3% during the first quarter of 2018. By December 2017, bitcoin had a total market cap of ¥12 trillion, and current trends suggest that Japanese personal consumption could rise between ¥0.2 to ¥0.4 in the next year. The analysts have labeled this phenomenon as The Bitcoin Effect.

The analysts offered valuable insight into the unique relationship between bitcoin and Japanese consumers. Nomura, specifically, is one of the world's most prominent and largest independent investment banks. It is famous for sponsoring mathematical pursuits to aid in financial technology innovation and research.

The Deutsche Bank AG has recently published a report about the bitcoin phenomenon. In their report, the bank notes that in Japan, the majority of retail investors are shifting from leveraged foreign-exchange to a more leveraged cryptocurrency trading. The report included a Nikkei telling of Japanese investors, which currently account for half of the globe’s foreign-exchange transactions. This makes it seem more plausible that Japanese users would account for at least for 40% of all bitcoin participation.

More surprisingly, analysts Suimon and Miyamoto pointed out that Japanese consumers are also benefiting from the country’s enthusiasm regarding cryptocurrencies. According to the analysts, Japan is currently experiencing a wealth effect, thanks to bitcoin. A similar event occurred in the 1960s in the US following a double-digit tax increase. While economists at the time predicted that consumer spending would decline, the stock market seemed to rise, and the average American reported feeling wealthier.

According to Nomura analysts, the last quarter of 2017 saw Japan’s GDP rise by 0.3%. This is likely to further increase during the first quarter of 2018. In addition, the Nomura analysts created a formula: every increase of asset value equal to ¥10 billion will generate a consumption rise between ¥0.2 to ¥0.4 billion.

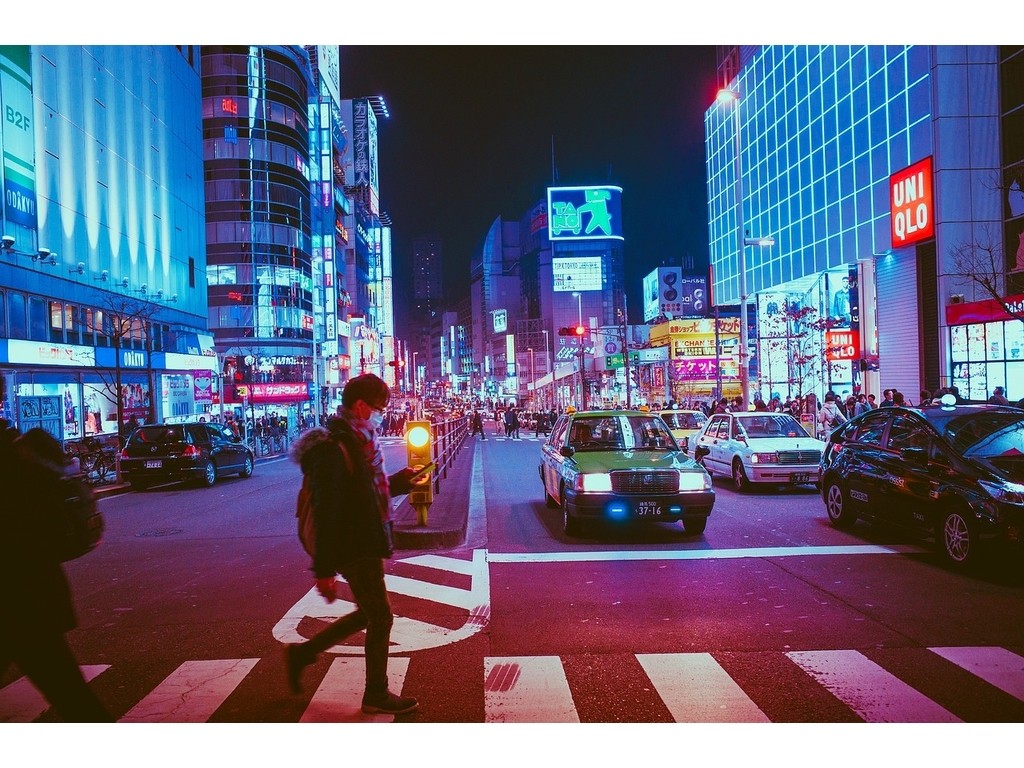

In April 2017, Japan announced a progressive attitude towards bitcoin, and other altcoins, when the Payment Services Act officially legalized cryptocurrency trading. After China banned cryptocurrency trading, Japan rose to fill the void left by the world’s most active cryptocurrency country. Last year, bitcoin boasted with a remarkably high market cap, which has likely acted as a catalyst for The Bitcoin Effect.

According to Suimon and Miyamoto, the country likely accounts for ¥5.1 trillion of the total market cap. While this does not necessarily translate directly into the Japanese mainstream economy, it is likely to have encouraged the increase in personal consumption.

According to Professor Geoffrey Smith, from Arizona State University, cryptocurrencies offer different benefits, which are attractive to different individuals. Some individuals might be drawn to its speculative nature, while others are attracted to its decentralized nature and anonymous transactions.

The last year has been a major one for bitcoin, in particular, and it is likely that Japan won’t be the only country experiencing an increase in personal consumption.

The analysts offered valuable insight into the unique relationship between bitcoin and Japanese consumers. Nomura, specifically, is one of the world's most prominent and largest independent investment banks. It is famous for sponsoring mathematical pursuits to aid in financial technology innovation and research.

The Deutsche Bank AG has recently published a report about the bitcoin phenomenon. In their report, the bank notes that in Japan, the majority of retail investors are shifting from leveraged foreign-exchange to a more leveraged cryptocurrency trading. The report included a Nikkei telling of Japanese investors, which currently account for half of the globe’s foreign-exchange transactions. This makes it seem more plausible that Japanese users would account for at least for 40% of all bitcoin participation.

More surprisingly, analysts Suimon and Miyamoto pointed out that Japanese consumers are also benefiting from the country’s enthusiasm regarding cryptocurrencies. According to the analysts, Japan is currently experiencing a wealth effect, thanks to bitcoin. A similar event occurred in the 1960s in the US following a double-digit tax increase. While economists at the time predicted that consumer spending would decline, the stock market seemed to rise, and the average American reported feeling wealthier.

According to Nomura analysts, the last quarter of 2017 saw Japan’s GDP rise by 0.3%. This is likely to further increase during the first quarter of 2018. In addition, the Nomura analysts created a formula: every increase of asset value equal to ¥10 billion will generate a consumption rise between ¥0.2 to ¥0.4 billion.

In April 2017, Japan announced a progressive attitude towards bitcoin, and other altcoins, when the Payment Services Act officially legalized cryptocurrency trading. After China banned cryptocurrency trading, Japan rose to fill the void left by the world’s most active cryptocurrency country. Last year, bitcoin boasted with a remarkably high market cap, which has likely acted as a catalyst for The Bitcoin Effect.

According to Suimon and Miyamoto, the country likely accounts for ¥5.1 trillion of the total market cap. While this does not necessarily translate directly into the Japanese mainstream economy, it is likely to have encouraged the increase in personal consumption.

According to Professor Geoffrey Smith, from Arizona State University, cryptocurrencies offer different benefits, which are attractive to different individuals. Some individuals might be drawn to its speculative nature, while others are attracted to its decentralized nature and anonymous transactions.

The last year has been a major one for bitcoin, in particular, and it is likely that Japan won’t be the only country experiencing an increase in personal consumption.