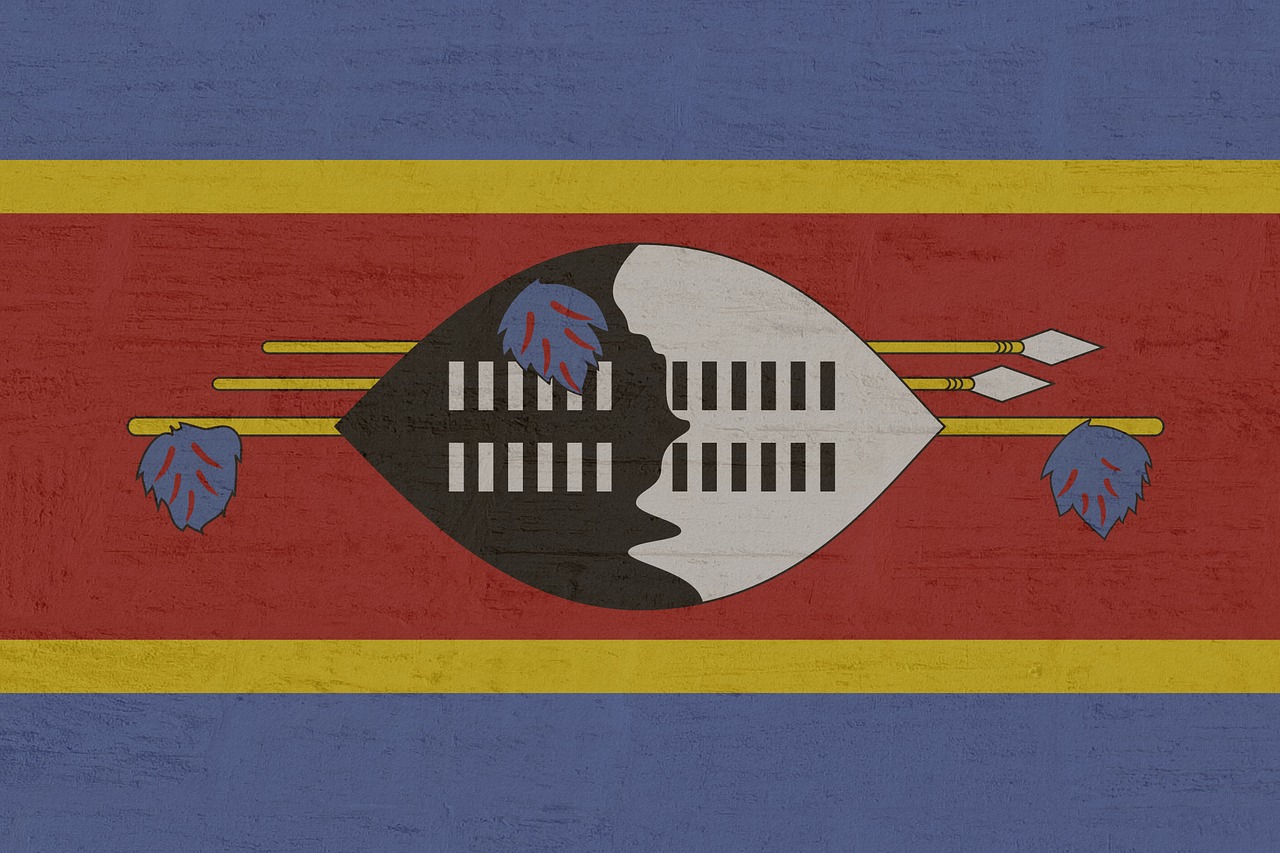

Different countries’ governments have different policies regarding the use and trade of digital currencies. Some are making efforts to regulate them, few intend to issue a complete ban on them, and others recognize virtual currencies as an innovative technology and plan on making use of them after thorough research. South African country, Swaziland appears, to be one of the latter.

Although the Central Bank of the Kingdom of Swaziland (CBS) has not issued any definite statements on the topic, it has signaled its optimism towards the deployment of digital currency. The bank is cautious towards embracing the use of cryptocurrencies but is assessing the possibility of using them within the country, as claimed by the Governor of the country’s central bank during the Swaziland Economic Conference (SEC) 2017 last week.

Chief Majozi Sithole, of the CBS, said that digital currency is an innovation that needs to be studied thoroughly before its use but should not be completely dismissed. “It may not be wise to dismiss virtual currencies and as the CBS we are learning and we want to accept and support innovation. If this is innovation, we do not want to stifle it. We want to learn more about it. Even with Mobile Money it took time for us to know what it is and we liaised with countries that have succeeded at it,” he told the attendees.

Cryptocurrencies are digital currencies that fall under the financial technology (FinTech) space and operate independently of central banks. Sithole said that these unregulated currencies pose a risk to their traders. He said, “we are aware that people are trading on these platforms and we want to caution people to be careful. This has become a topical issue globally and we are studying it and continually talking to experts on this issue.”

The CBS also indicated its interest in cryptocurrencies in an internal news circular published in August 2017. In the document, the central bank’s senior communications officer, Lindokuhle Sithole Shabangu, gave a brief introduction of the technology and stated that the bank is carrying out thorough research on the use of latest and most efficient payment systems.

She said, “in essence, the Central Bank, in line with its mandate to issue and redeem currency as well as to promote safe and accessible payment systems, continues to closely monitor developments in the financial services industry with a view to ensure that the regulatory framework remains relevant and appropriate.”

Central Bank of Swaziland considers deploying digital currencies

Different countries’ governments have different policies regarding the use and trade of digital currencies. Some are making efforts to regulate them, few intend to issue a complete ban on them, and others recognize virtual currencies as an innovative technology and plan on making use of them after thorough research. South African country, Swaziland appears, to be one of the latter.