Part I

Nobody would be surprised if cryptocurrencies have been used for nefarious means, the same could be said for any measure of currency that exists. But what if you found out the industry has been systematically exploited to blatantly launder cartel cocaine money right underneath our noses (pun intended)?

After all, the Devil's greatest trick is convincing the populace he doesn’t exist.

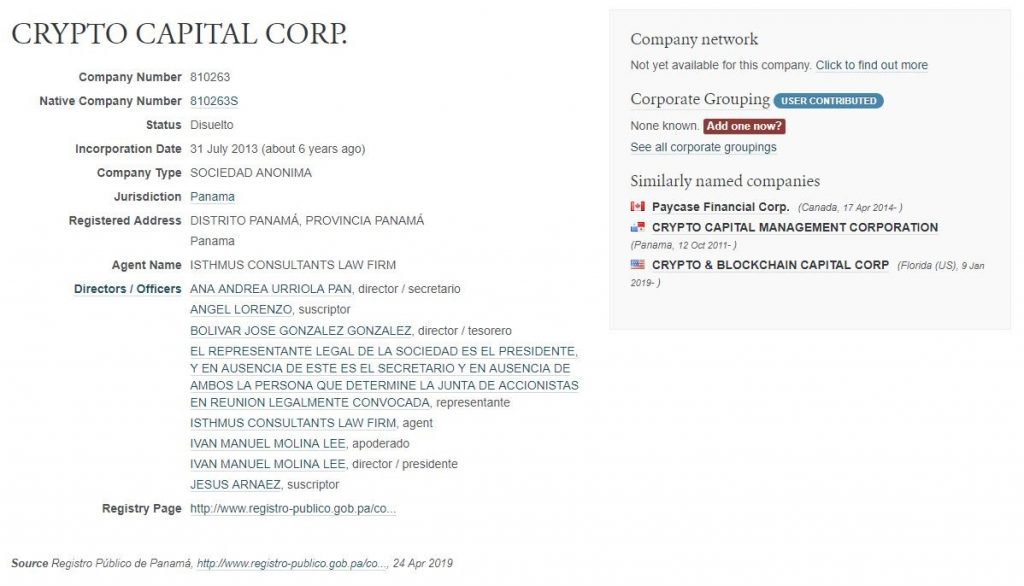

CryptoCapital - A Shady History

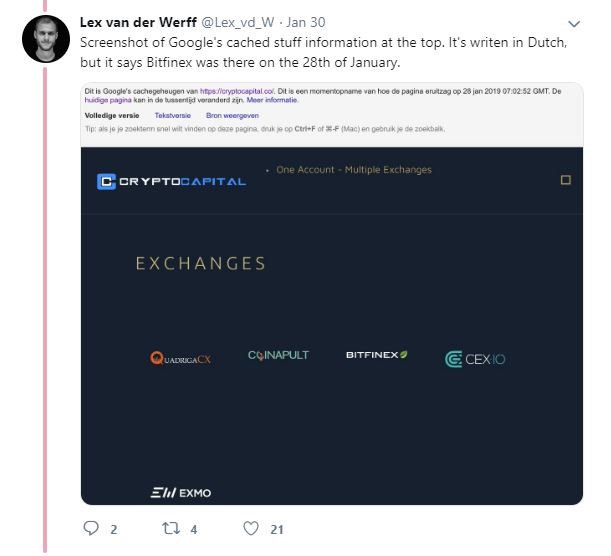

Mathias Grønnebæk, an early ETH developer, was one of the earliest people who noticed that a number of crypto companies are connected to a remote company. CryptoCapital, a fiat banking platform, is responsible as the banking/payment processor for a number of platforms, namely Decentralized Capital, Bitfinex, QuadrigaCX, CEX.io, etc.

Yet they are relatively anonymous, with only a few known details of significance; such as the fact that they are a Switzerland-based company and headquartered out of Panama.

Anonymity is not a crime, but for a company with smudgy associations, it’s a huge red flag, especially when a number of associated companies shares similar sketchy traits. Where there is smoke, there is usually fire. [1]

CryptoCapital’s conception can be traced back to Reddit user /u/Bitfan2013, who has divulged a few key details throughout his post history. It is known that the user is from a family of bankers, and were involved with the Panamanian acquisition of Havelock 5 years ago as well.

Havelock Investments was the investment platform used to IPO Crypto Financial, the original name of CryptoCapital. Once a popular choice for users to invest in crypto projects, it has since gained a reputation for associations to security fraudulent projects. It is rather curious that a company has to circle around and buy out it’s originating platform, perhaps as an attempt to control sensitive information.

[2] The trail goes further, as CryptoCapital is also linked to a Polish company, Crypto Sp. Z.O.O. This company secured and provided a banking account for both Bitfinex and CEX.io with a Polish bank, Bank Spółdzielczy w Skierniewicach, which translates to Cooperative Bank in Skierniewice.

For scale reference, this smaller sized bank only had assets of around $13 million in 2011, making estimated profits of ~$5 million. Coincidentally, it’s also the equivalent of what Bitfinex handles in around one hour.

Crypto Sp. Z.O.O’s ownership can be traced back to CryptoCapital, and the director of both Crypto Sp. Z.O.O and CryptoCapital is one Ivan Manuel Molina Lee, who is thought to be an accountant, or a consultant. This individual is thought to be a “shell” CEO for hire, a scapegoat for those who would want to mask their identity.

While the working history of the company goes further, details are surfacing as evidence of money laundering and nefarious activities have been coordinated by the individuals behind CryptoCapital.

Some of our questions:

- Why would a Swiss based company be headquarter in Panama?

- Why the need for multiple 'shell' corporations?

- Why so anonymous?

In the following sections, we'll be publishing our findings when looking into the answers to these questions, and what we've found.

Part II

Laundering money is one of the hardest things for cartels to do... so we are told. As Part 2 unfolds, we dig into the “potential” cartel involvement and start to paint the larger picture of how this is all intertwined together.

Cartel association

On April 7th of 2018, reports originating from sources in Poland informed readers that Polish prosecutors seized €400 mil from two companies, referred to as company M and company C, involving a long link of individuals and eventually leading to Bitfinex; and potential association to cartel involvements.

[1] The story began when the Belgian Ministry of Foreign Affairs was in the process of building a new embassy in the Democratic Republic of the Congo. Company M, owned by a Canadian of Panamanian descent, impersonated the building contractor and intercepted the $400mil payment. Through an investigation with Interpol, it was revealed that company M was associated with company C, owned by a Colombian with Panamanian citizenship, who was in turn associated with a large online exchange of cryptocurrencies.

Polish authorities reported that the two companies specialize in money laundering. “The scale of financial operations indicates that these bills were to hide money from smuggling cocaine to Europe. The companies were also used for large scale scams. Criminals have hidden their operations, also exchanging money for cryptocurrencies, obliterating traces.”

The funds from the two companies were deposited at a branch of one of the banks in the accounts of the two companies registered in Poland, which is coincidentally the Banku Spółdzielczym w Skierniewicach – the bank where Bitfinex is registered. Surprise!

A forum user admitted to being a interrogated witness in the case, and that the company has paid them used a Bitfinex account, further strengthening the allegations. [2]

Now why would Bitfinex need to pay a witness? And what does that have to do with CryptoCapital? [3]

Members of CryptoCapital Management

Well, when Bitfinex opened its Polish bank account in Nov 2017 with the reported intention of trading euro pairs, the company name under the account was registered as Crypto SP, and as located in Panama. This company, Crypto SP, is owned by Crypto Capital Corp, the director of which is the very same Ivan Manuel Molina Lee.

But according to them? Nothing! CryptoCapital has since denied affiliations to the scandals and associated materials, contents, and media related to Bitfinex has subsequently been removed. This was not the first incidence of CryptoCapital removing bad publicity.

So the reality is we have two companies known for money laundering putting their cash into the same bank as Bitfinex. Furthermore, one of the owners of these companies is affiliated with a large online exchange and also has Panamanian citizenship, where CryptoCapital is based out of.

If you think the picture can't be clearer, wait for Part 3...

Part III

This is where the pieces come together. Have you noticed how often Bitfinex has been referenced in this story? It doesn't feel like a coincidence.

Tether (USDT)

Aside from the multiple incidences of hacks and lost funds, Bitfinex also still have to answer for their sister company's controversies, Tether. It is no secret that Bitfinex and Tether have received subpoenas from U.S regulators. [1]

Speculations that Bitfinex has been “operating a fractional reserve and is covering over its reserve deficit in complicity with Bitfinex” has existed since early 2017. These allegations are nothing new. [2]

And remember when Bitfinex and CryptoCapital supposedly severed official relations? Not even a few months later, Bitfinex is still associated with CryptoCapital, and the relationship has not improved for the better.

According to statements in April 26, 2018, Bitfinex sent $850 million of customer and corporate funds to CryptoCapital Corp., and along the way it was “lost”. Representatives of Bitfinex and Tether reported to the NY Attorney General’s office that CryptoCapital claims the funds were seized by Portugese, Polish, and American government officials.

An official confirmation submitted by Bitfinex stated that their respondents did not believe CryptoCapital’s representations that the funds have been seized.

Meanwhile, the $850 million loss severely impaired Bitfinex’s ability to process funds and withdrawal requests as “CryptoCapital, which held all or almost all of Bitfinex’s funds, refused to process customer withdrawal requests and refused or was unable to return any funds to Bitfinex.”

This clearly caused Bitfinex major difficulties and processing delays, despite official denials from the company’s representatives.

Allegedly, funds from Tether’s reserve were then used to make up the shortfall, but neither the loss nor Tether’s fund movements were disclosed to customers and investors. If true, this would very much validate the speculations of 2017. [3]

It is also a testament to the fact that CryptoCapital has never had a good public reputation. CryptoCapital never had the performance track record of being the most reliable financial processor either. Complaints regarding speed and reliability have been a common occurrence and regularly affect related exchanges. It is very questionable how they earned the reputability needed to associate with such a wide network of exchanges. [4]

It would also explain Bitfinex’s history of hostility towards critics, especially ones who would question the secrecy of their banking processes, unsurprisingly. The company is known to respond defensively to negative comments by threatening accusers with legal litigation, instead of transparency. [5]

But not just Bitfinex, remember CryptoCapital’s very well connected network. Their website names among its customers the now-defunct QuadrigaCX and Coinapult, among others. And according to the Wayback Machine, past customers also included exchanges like Kraken, BTCC, and Bitt.

Yet it seems as time progresses, the number of CryptoCapital’s allies dwindle.

Most have met their ends under questionable circumstances. Not just exchanges such as QuadrigaCX and Coinapult (whose office was reportedly across the hall from CryptoCapital), but internal members as well in more recent times.

Part IV

For the finale, let us show you where the Part I – III have been leading. Though this is not the end of the “rabbit holes” we have been following, it is the point where we felt comfortable to really form a solid hypothesis of what is going on based on all of the data we have found.

Bank frauds

As of April 30th, 2019, two individuals were charged with bank fraud in connections to cryptocurrency exchanges. Court documents released by the Justice Department reported that the alleged money services businesses operated between February and October 2018. It is interesting to note that this is within the same time frame as when Bitfinex saw $850mil disappear. Prosecutors say during this time, the two “opened and used numerous bank accounts at financial institutions that were insured by the [FDIC]”. [1]

Two of the bank accounts named in the court document are allegedly held under the name Global Trading Solutions LLC, one apiece from HSBC Bank USA and HSBC Securities USA/Pershing LLC.

Global Trading Solutions LLC is tied to licensed financial institution Global Trade Solutions AG. Global Trade Solutions is the parent company of CryptoCapital, and is cited as parent company on CryptoCapital’s website.

The two individuals are Reginald (Reggie) Fowler, former co-owner of the NFL’s Minnesota Vikings, and Ravid Yosef, from Tel Aviv, Israel. Both have been charged by the Southern District of New York (SDNY) with bank fraud and conspiracy to commit bank fraud. Fowler is also accused of running an unlicensed money transmission business and conspiracy related to its operations.

Global Trading Solutions LLC, owned by Fowler, was directly connected to CryptoCapital. As written in the indictment, Fowler and Yosef obtained bank accounts after “falsely representing to those banks that the accounts would be primarily used for real estate investment transactions even though Fowler, Yosef, and others used them to transmit funds on behalf of an unlicensed money transmitting business related to the operation of cryptocurrency exchanges.”

The others in that quote includes CryptoCapital, or rather the Swiss-based Global Trade Solutions AG that runs its operations. Both bank accounts, including the one at HSBC, was used by CryptoCapital to process fiat deposits for Bitfinex. Global Trading Solutions LLC also had multiple bank accounts at Citibank, Enterprise Bank & Trust and Wells Fargo; all used by CryptoCapital.

Fowler additionally co-owns two Portuguese companies through which, CryptoCapital also used to processed fiat withdrawals for Bitfinex.

As the indictment clarifies, Fowler and Yosef opened numerous bank U.S. accounts under false pretenses. The indictment further presents a list of bank accounts at HSBC, either in the name of Global Trading Solutions LLC or directly in Fowler’s name, from which the funds were seized by the U.S. Government.

This seems to confirm the statements that the $850mil Bitfinex funds were not lost, but were in fact held by the authorities.

The multitude of bank accounts in the name of Global Trading Solutions LLC, and used by CryptoCapital, provides insights and understanding into how Fowler attempted to obfuscate his association with Global Trading Solutions LLC.

For further affirmation, the address of the known HSBC accounts matches the address in Chandler, Ariz. where Global Trading Solutions LLC is registered. Yet the property at that address, a sports complex, is officially owned by another company that is related to Fowler.

As the cryptocurrency publication The Block elaborates more into the story, another bank account at Wells Fargo is listed with an address in Tampa, Fla. That address lists a different company called NLE Consulting, whose registry documents includes Fowler as an officer. CryptoCapital has used the account for its own customers, but there is no indication that it was used to process any Bitfinex fiat deposits or withdrawals. Fowler also used an address in Huntington Beach, Calif. to obtain an account at Citibank. However, no other company is registered at the listed address.

Due to the result of certain AML and financial crimes investigations by the United States’ FBI and cooperative international law enforcement and/or regulatory agencies, according to a letter Ivan Molina published in December of 2018, Global Trade Solutions and related entities have been denied banking services in the U.S, EU, and other international locations.

In the same letter, Ivan confirms the account seizures at HSBC in London, as well as bank accounts in the U.S being frozen and blocked, and banking services and access terminated. He also referenced the article by The Block, reporting the use of Global Trading Solutions LLC’s services for depositing funds to Bitfinex.

At this point, it’s not too much of a stretch to assume the same shady approach was used for most, if not all, of CryptoCapital’s affiliated companies to operate under similar questionable structures. (CEX.io, QuadrigaCX, other dead/sketchy companies).

When there is this much evidence and association, it can no longer be brushed off as coincidence.

Additional Sources:

https://cointelegraph.com/news/bitfinex-tether-get-subpoenas-from-us-regulators

https://cointelegraph.com/news/unconfirmed-polish-prosecutors-seize-400-mln-amid-allegations-bitfinex-is-implicated-in-fraud

https://www.bloomberg.com/news/articles/2017-12-05/mystery-shrouds-tether-and-its-links-to-biggest-bitcoin-exchange

https://www.coindesk.com/bitfinex-ny-prosecutors-tether-850-million-allege

https://github.com/ccxt/ccxt/issues/4826

https://bitcointalk.org/index.php?topic=5118599.0

https://bitcointalk.org/index.php?topic=2822223.0

https://bitcointalk.org/index.php?topic=2810707.0

https://www.coindesk.com/bitfinex-vs-bitfinexed-exchange-hires-law-firm-challenge-critics

https://cointelegraph.com/news/worlds-largest-bitcoin-exchange-bitfinex-threatens-critics-with-legal-action

https://www.financemagnates.com/cryptocurrency/news/bitfinex-mixed-colombian-cocaine-polish-media-reports/

https://forum.bitcoin.pl/viewtopic.php?f=79&t=28309&p=472711#p472711

https://twitter.com/rolflobker/status/1090542851262423040

https://opencorporates.com/companies/pa/810263

https://cointelegraph.com/news/bitfinex-in-poland-were-there-money-laundering-links

https://medium.com/@mathias_61938/the-man-behind-the-curtain-81ecf49fa339

https://medium.com/@krma_0/when-bitfinexed-isn-t-enough-7e2cb7eff273

https://www.trustnodes.com/2017/11/22/bitfinex-reveals-new-polish-bank-account-panama-registered-company

https://cointelegraph.com/news/bitfinex-in-poland-were-there-money-laundering-links

https://www.coindesk.com/two-charged-with-running-shadow-banking-service-for-crypto-exchanges

https://www.theblockcrypto.com/2019/05/01/indictment-reveals-new-clues-to-the-crypto-capital-situation/

Editor's note: This article was originally posted as a four-part series on SynQ I/O and has been republished with permission.