An anonymous report written about tether (USDT) worries it is sustaining bitcoin's inflated price. The write-up applies a principle common in forensic accounting, Benford's Law, to find hints of fraud in tether's distribution. That conclusion comes from the assertion that rises in BTC correlate heavily with the issuance of new USDT on the market.

"Tether printing moves the market appreciably; 48.8% of BTC’s price rise in the period studied occurred in the two-hour periods following the arrival of 91 different Tether grants to the Bitfinex wallet," the unknown author of tetherreport.com states.

The token, pegged to the US dollar, has been the object of controversy for months. In April, relationships with Taiwanese banks broke down, suspending deposits and withdrawals. Simultaneously, production of tether ramped up, despite losing the ability to create reserves with banks. The biggest assertion the report makes is that if tether indeed pumps up the price of bitcoin, then the latter should be valued around $2,000.

"Author’s opinion - it is highly unlikely that Tether is growing through any organic business process, rather that they are printing in response to market conditions," the report asserts.

So is tether minting USDT then transferring the tokens to parent company Bitfinex's exchange in order to inflate the price of BTC? That question plagues the market, as it would point to a scam that would bring in USD and BTC revenue in exchange for the USDT.

The report's statistical analysis concludes: "The price data suggests that Tether may not be minted independently of bitcoin price and may be created when bitcoin is falling; it also rejects the notion that tether is not having a great influence on the bitcoin price."

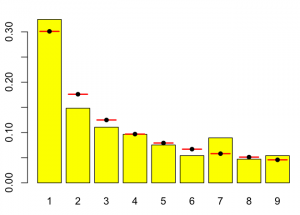

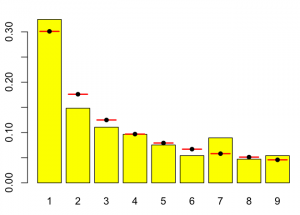

Benford's Law, a principle in statistics, dictates that the plurality of numbers over a large given range will start with a "1" (about 30 percent). From there, a smaller share of numbers in a sequence should begin with a "2", an even smaller set with a "3", and so on. There may be some variation in the latter numbers depending on the sample size.

It's a useful idea for forensic accountants, who use it to measure indications of fraud. If the distribution of given numbers (i.e. the amount of a set of transactions on a crypto exchange) does not fit that rule, there's a strong hint of fraud.

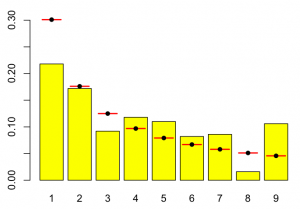

Comparing a sequential sampling of 500 transactions from the deposit wallet of Bitfinex to those from another wallet, in this case Bittrex, the author found the Bitfinex exchange transactions violated the rule. In the below diagram, the number of deposits that start with a "1" outnumber other digits. The scale goes down progressively until the latter digits, where there is some variation.

[caption id="attachment_3830" align="alignnone" width="300"] The plurality of Bittrex deposits start with a "1", meeting Benford's Law describing a normal distribution of amounts (Source: tetherreport.com)[/caption]

The plurality of Bittrex deposits start with a "1", meeting Benford's Law describing a normal distribution of amounts (Source: tetherreport.com)[/caption]

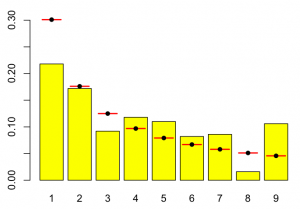

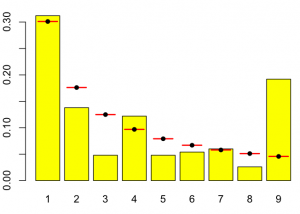

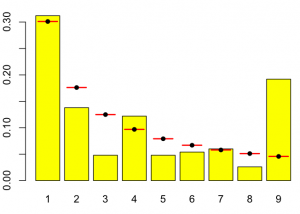

This was not the case with the Bitfinex deposits. The author evaluated two sets of Bitfinex deposits, one on January 4, 2018 and another on January 14, 2018, immediately following the printing of new tether.

[caption id="attachment_3829" align="alignnone" width="300"] A sampling of 500 tether transactions from Bitfinex on January 4, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

A sampling of 500 tether transactions from Bitfinex on January 4, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

[caption id="attachment_3831" align="alignnone" width="300"] A sampling of 500 tether transactions from Bitfinex on January 14, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

A sampling of 500 tether transactions from Bitfinex on January 14, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

Looking at transactions at Poloniex and Kraken as well, the researcher pointed out, "Overall there are some very interesting patterns at play, especially the overabundance of leading "9"s and a uniform paucity of leading "3"s and "8"s in the transaction data." He suggests that this should be enough to raise red flags and "to question whether coordinated market manipulation could be occurring."

Without offering a definite conclusion, the author expresses confidence that the data certainly credits tether with some of the rise in bitcoin prices. Doubts about tether's legitimacy are motivating competing stablecoins to hit the market, including TrueCoin last week and MakerDAO's DAI in late 2017.

"Tether printing moves the market appreciably; 48.8% of BTC’s price rise in the period studied occurred in the two-hour periods following the arrival of 91 different Tether grants to the Bitfinex wallet," the unknown author of tetherreport.com states.

The token, pegged to the US dollar, has been the object of controversy for months. In April, relationships with Taiwanese banks broke down, suspending deposits and withdrawals. Simultaneously, production of tether ramped up, despite losing the ability to create reserves with banks. The biggest assertion the report makes is that if tether indeed pumps up the price of bitcoin, then the latter should be valued around $2,000.

"Author’s opinion - it is highly unlikely that Tether is growing through any organic business process, rather that they are printing in response to market conditions," the report asserts.

So is tether minting USDT then transferring the tokens to parent company Bitfinex's exchange in order to inflate the price of BTC? That question plagues the market, as it would point to a scam that would bring in USD and BTC revenue in exchange for the USDT.

The report's statistical analysis concludes: "The price data suggests that Tether may not be minted independently of bitcoin price and may be created when bitcoin is falling; it also rejects the notion that tether is not having a great influence on the bitcoin price."

Benford's Law and Tether

Benford's Law, a principle in statistics, dictates that the plurality of numbers over a large given range will start with a "1" (about 30 percent). From there, a smaller share of numbers in a sequence should begin with a "2", an even smaller set with a "3", and so on. There may be some variation in the latter numbers depending on the sample size.

It's a useful idea for forensic accountants, who use it to measure indications of fraud. If the distribution of given numbers (i.e. the amount of a set of transactions on a crypto exchange) does not fit that rule, there's a strong hint of fraud.

Comparing a sequential sampling of 500 transactions from the deposit wallet of Bitfinex to those from another wallet, in this case Bittrex, the author found the Bitfinex exchange transactions violated the rule. In the below diagram, the number of deposits that start with a "1" outnumber other digits. The scale goes down progressively until the latter digits, where there is some variation.

[caption id="attachment_3830" align="alignnone" width="300"]

The plurality of Bittrex deposits start with a "1", meeting Benford's Law describing a normal distribution of amounts (Source: tetherreport.com)[/caption]

The plurality of Bittrex deposits start with a "1", meeting Benford's Law describing a normal distribution of amounts (Source: tetherreport.com)[/caption]This was not the case with the Bitfinex deposits. The author evaluated two sets of Bitfinex deposits, one on January 4, 2018 and another on January 14, 2018, immediately following the printing of new tether.

[caption id="attachment_3829" align="alignnone" width="300"]

A sampling of 500 tether transactions from Bitfinex on January 4, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

A sampling of 500 tether transactions from Bitfinex on January 4, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption][caption id="attachment_3831" align="alignnone" width="300"]

A sampling of 500 tether transactions from Bitfinex on January 14, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]

A sampling of 500 tether transactions from Bitfinex on January 14, 2018. The distribution does not conform to Benford's Law. (tetherreport.com)[/caption]Looking at transactions at Poloniex and Kraken as well, the researcher pointed out, "Overall there are some very interesting patterns at play, especially the overabundance of leading "9"s and a uniform paucity of leading "3"s and "8"s in the transaction data." He suggests that this should be enough to raise red flags and "to question whether coordinated market manipulation could be occurring."

Without offering a definite conclusion, the author expresses confidence that the data certainly credits tether with some of the rise in bitcoin prices. Doubts about tether's legitimacy are motivating competing stablecoins to hit the market, including TrueCoin last week and MakerDAO's DAI in late 2017.