The blockchain is revolutionizing every aspect of our lives and has impacted every market segment. From banks to retailers, the blockchain hype is reshaping our lives just like the .com boom did in the early 2000s.

So far, we have seen the blockchain technology being applied onto healthcare, commerce, logistics, assets management, and the list goes on. Bitcoin is just the tip of the iceberg, known as the blockchain. The technology is so often called out alongside Bitcoin that it has practically become synonymous with the word, bitcoin.

However, reality is different and the blockchain has far reaching applications in almost all industry sectors. Basically, the blockchain is centered on the utilization of a public digital ledger to share information in a very secure, fast, and incorruptible manner.

Now, a group of entrepreneurs and developers have gotten together to apply the blockchain technology onto the most difficult market to penetrate; the real-estate market.

The real-estate market or the housing market has been one of the most robust and successful investments in the US. Despite the 2008 market crash, the real-estate market was quick to recover and as compared to 2000, the prices of houses in San Francisco have increased by more than 60%. In New York, the change was around 30%.

This all represents an opportunity for investors to gain high returns, however, the real-estate market is the most challenging one to penetrate. Getting into it usually requires a large amount of capital and returns are usually slow, distributed over years in some cases.

This is where Slice comes in, the blockchain powered project that aims to revolutionize the real-estate investment industry.

How it works

Investors will not be required to pile up their life savings to invest in the real-estate market, Slice will allow them to invest in the market via a process that is somehow similar to investing in the stock market. The following points explain the benefits of investing through Slice:

Cross-border transactions

It has always been difficult to invest in the real-estate market of another country. However, with Slice, you can easily invest in any property in any place, from the comfort of your home.

Institutional grade real-estate

Slice will be offering its investors prime, institutional grade real-estate. For investors, this means guaranteed returns, and a safe investment in the market.

Liquidity

Another major constraint that stops people from investing in the real-estate sector is that the investment cannot be liquidated quickly. If you own a house, you would be well aware of the fact that it takes time and patience to find the right buyer for your property. Slice eliminates this constraint by not binding the investors with the asset in which they are investing. Investors can liquidate their investments, thanks to the reserve fund that is enabled within each project on the platform.

Slice is launching its first pilot with HNWI cyrpto investors; It helps them to diversify their portfolio and deploy crypto into institutional grade commercial real-estate. Slice’s first project is in Chelsea, Manhattan NYC where the platform had secured $2.4M allocation out of $80M equity capital stack in a $380M project backed by leading RE investors. It would open it’s LA location offering by May and would be expanding to other locations thereafter. Slice is focusing on prime US locations only with institutional grade real-estate that generate stable private market returns to investors.

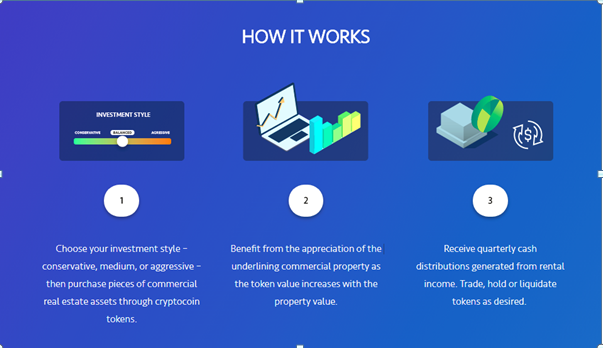

To invest in the market using Slice, you simply need to create an account and follow the steps presented in the following infographic:

Image credit: slice.market

The Team and Partners

Ari Shpanya- co-founder and CEO at Slice. During the past 18 months, he founded and provided advice to many property tech companies such as HomeShare, Propy, and Blok living. He is a graduate of the GSB Stanford Ignite program. Formerly, he was the CEO and founder of Wiser.com (acquired Sep 2016).

Tomer Ravid- chief investment officer at Slice, and financial engineer. Formerly, he led private equity investments at Profimex Real-Estate. He was also an advisor to the Israeli blockchain forum, and also a co-founder of Blox tax.

Yev Spektor- CTO and full-stack engineer. He is also a lead developer at Fr8 blockchain project.

Henry Elder- Director, Origination & Investments. Henry specialized in value-add and transitional multifamily, as well as commercial properties in the US market. He is a graduate of Pepperdine University, and his experience at Latitude RE Investors includes being an originator responsible for the origination, structuring, underwriting, closing, and management of over $500 million in debt investments.

Paul Monsen- Director of RE Strategy & Biz dev. Paul’s vast commercial real-estate experience in the private market, focused on providing senior and subordinated financing in a wide array of industries. Paul structured multiple financing solutions such as term loans, structured financing, and working capital financing supported by equipment and real estate collateral.

Some notable advisors on the Slice team are:

- Eyal Hertzog (Co-founder of Bancor)

- Brit Yonge (Co-founder of Lightyear and Stellar)

- Guy Zyskind (CEO and co-founder of Enigma)

Get the latest market information for all tokens and coins with Cointelligence's cryptocurrency list, or look for real estate tokens on our list of security tokens.