In 2018, the partnership between Nick Ayton and David Lofts publicly dissolved, as spelled out in open letters that each shared with the other over their disappointment over progress on the 21 Million TV show project (21M), and the handling of 21M funds. Why are we examining a story that happened over a year ago? Because Ayton and Lofts were also partners in Chainstarter, a company which continues to advise ICOs and STOs.

Nick Ayton and Chainstarter came to my attention due to a now-deleted post by Crypto Police, which was reposted by Paul Cliffe on LinkedIn. At Cointelligence, we can’t ignore scams, scam enablers, or corruption. Whenever we see it, we call it out. So I began to investigate further. Paul put me in touch with David Lofts, who provided me with his side of the 21 Million and Chainstarter story, as well as the two open letters shared below.

This is a complicated situation with a lot of blame being thrown around. I’ve decided not to take a side in the matter, and instead present you with the letters, and some further facts, and let you decide for yourself how to interpret the situation.

On April 2nd, 2018, after lengthy private correspondence, David Lofts published an open letter to Nick Ayton airing his grievances. The open letter can be a bit difficult to parse because it refers to a lot of previous private conversations, but the main accusations are:

To be clear, I am neither supporting or denying Mr. Lofts’ claims. Instead, I invite you to read his letter in its entirety, read Mr. Ayton’s follow up (summarized below and also provided in full), and draw your own conclusions.

On April 6th, 2018, Nick Ayton published his own open letter to David Lofts. He starts the letter by making some counter-accusations of his own, and you may see some similar themes in the accusations. His primary complaints:

This is followed by some attempts to address the complaints that David aired in his letter, including the serious accusations of a pump-and-dump, which you can see spelled out in the letter itself.

Again, I am neither supporting or denying Mr. Ayton’s claims.

This is a serious dispute that will ultimately have to be settled in court between Mr. Ayton and Mr. Lofts. The rest of us can only consider it as outside observers and draw our own conclusions while we wait for a legal ruling.

In the wake of David Lofts’ ouster from the 21 Million project, both David and Nick have continued to work on their own versions of the project.

They each maintain their own websites (Nick Ayton’s 21milliontv.com and David Lofts’ 21million.co.uk), and are each still using the 21 Million name. When you speak to either of them about it, you can tell that they are both passionate about it. However the ICO funds were managed (more on that below), both men clearly wanted to actually make this TV show.

So the question becomes, who does this project belong to? In their open letters, each accuses the other of IP theft.

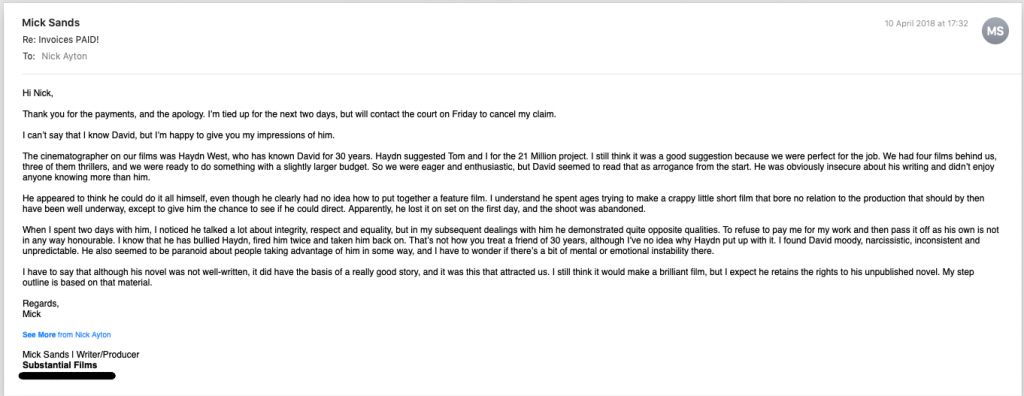

At no point has Nick Ayton denied that 21 Million was originally David Lofts’ idea. What he has questioned was whether David had anything more than an idea and an in-progress novel. In his open letter, he accused David of taking credit for other people’s work, and Nick provided us with email from the screenwriter to back up this claim:

But this doesn’t answer the legal question of who owns the rights to the 21 Million name. It’s one thing to see two similar projects developed simultaneously (such as Netflix and Hulu’s dueling Fyre Festival documentaries, or those studios which specialize in cheap direct-to-video knock-offs of blockbuster films), but two projects with the same concept and the same name?

Does Nick Ayton have the right to continue to develop the project originally conceptualized by David Lofts? I actually don’t know, as I’m not privy to all of the details of whether the IP rights become property of The 21 Million Project when that company was formed, or whether they remained with David Lofts. That’s honestly between Nick and David, and I’m merely sharing it in case anyone with an interest in IP disputes wants to keep an eye on this to see what happens next, as this too may ultimately be decided in the court of law.

We have bigger things to talk about.

I reviewed a lot of emails and open letters and blog posts in the course of preparing this article, and there was one thing that both Mr. Ayton and Mr. Lofts can agree on: 21 Million made a loan of funds to Chainstarter, the ICO advisory company that Mr. Ayton and Mr. Lofts were also co-founders of.

Both men admit to this blatant misuse and misappropriation of investor funds from the 21M ICO.

The disagreement arises when it comes time to determine who authorized the loan. Mr. Ayton claims that he and Mr. Lofts both agreed to it. David Lofts denies this, stating that he never agreed to such a loan.

Regardless of who authorized it, I’d like us to all take a moment to think about this.

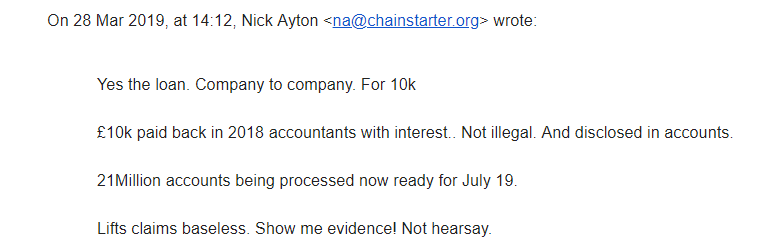

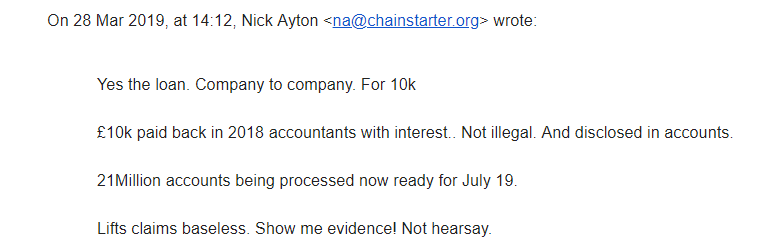

Chainstarter, a company which purports to advise ICOs and STOs on “Ethical Blockchain Funding”, was partially funded with a loan of funds from another company’s ICO. When I questioned Nick Ayton further about the loan, he insisted it was legal and paid back in full with interest:

It may be legal, but does it strike you as ethical?

To be clear, business-to-business loans aren’t that uncommon. But the issue here is two-fold. One, both businesses are owned by the same person. Two, these weren’t the business’s profits being loaned to another business with an expectation of earning interest on the investment. These were the investor funds which were intended to get the 21 Million project off the ground.

If you backed the 21 Million project, you did so with the intention of funding a TV show about a vast conspiracy related to cryptocurrency. Whether you did it because you thought it would be the Crypto DaVinci Code, or because you thought it was a sound investment that would offer a good return, that was what you intended to invest in. You were not investing your money so that 21M’s founders could then loan those funds to another project!

It might be tempting to say “Well, the money was paid back with interest, so it’s OK!” But that’s an “ends justifies the means” argument and ignores the possibility of the opposite happening. What if Chainstarter had crashed and burned? That would be 10k in investor money wasted on funding the founders’ unrelated other idea.

I have spoken with David Lofts, and he has told me that during his time at Chainstarter, it took a majority decision to agree to take on a client. He objected to several projects on the suspicion that they were either deliberate scams or just poorly-thought out. These included:

David alleges that Chainstarter opted to work with these clients against his objections. Envion has since gone into bankruptcy liquidation and was found guilty by FINMA of violating supervisory law, after their in-house counsel took off with some of the funds.

Chainstarter denies having worked with Envion or CryptoMillions. However, they do agree that they provided technology for Munchee, which went on to become one of the first ICOs shut down by the SEC. But they followed that up by saying they also called them out for their lies, and they appear to agree that the SEC was right in shutting them down.

This article by Andrew J. Chapin, who served as an advisor for Munchee, shows how the project went from something that seemed viable if not particularly groundbreaking, to being in clear violation of securities regulations.

In absence of any proof that Chainstarter did work with Envion or CryptoMillions, I don’t think a strong argument can be made for Chainstarter having a history of working with scams.

So if there’s no clear evidence of Chainstarter’s involvement with scams, and if the loan from 21 Million to Chainstarter was technically legal, why do I still have such a bad feeling about Chainstarter?

The thing is, even if Nick Ayton is truly dedicated to providing advice and technology for crypto projects to launch with full regulatory compliance, I don’t think I trust his judgment or his management skills.

He accuses David Lofts of all manner of misuse of company funds, and of not achieving much with the time and money he was given.

This strikes me as a gross case of mismanagement. And I don’t think Nick was being willfully negligent here. I don’t think he didn’t care what was happening with 21 Million funds, because I do think he thought the project was a great idea.

I think he made a mistake that I see happening over and over again in the crypto industry: he is overcommitted. Instead of choosing one thing and doing it well, he’s doing 20 things poorly, and missing the fact that his own business partner was spending investor funds on cars or what-have-you.

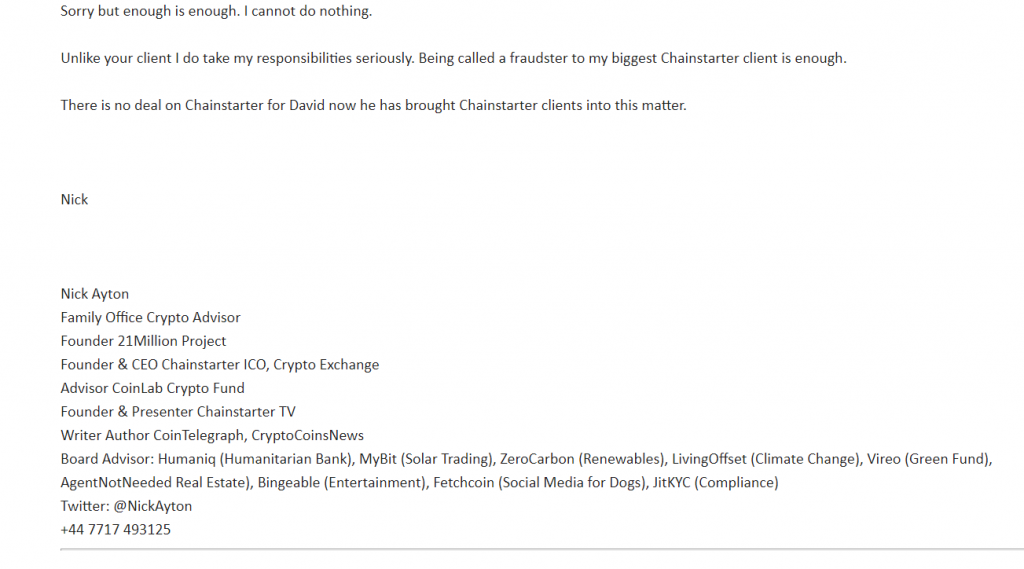

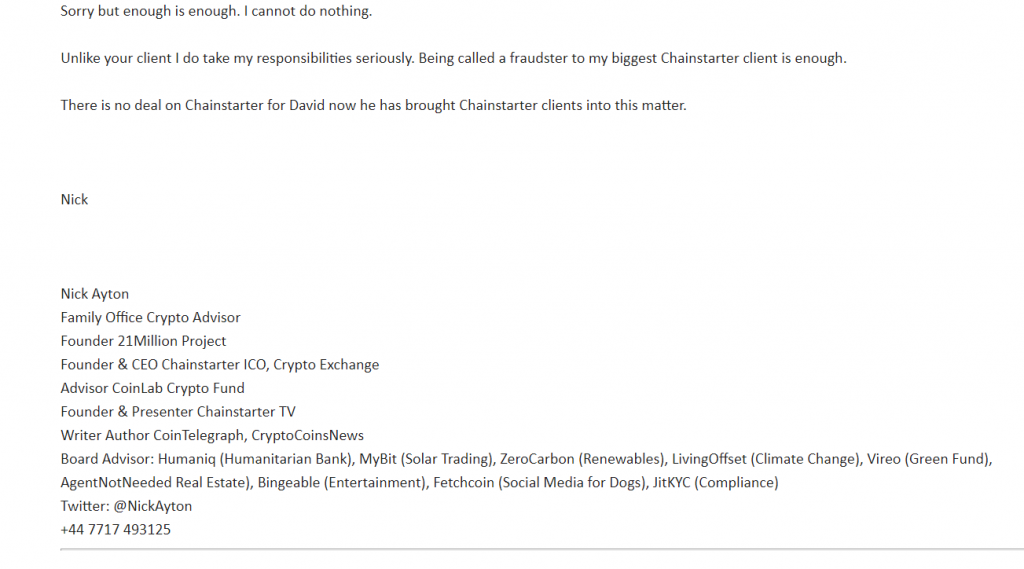

Let’s look at a signature from an old email that Nick forwarded to me:

Founder of several projects and CEO of one, author at two different sites, advisor on one fund, and board advisor on NINE projects. That’s a lot of plates to keep spinning at once.

That’s not to say that Nick was definitely actively advising all of those ICOs at once -- some of them could have been past projects that he was still proud of and sharing in his signature to establish his bona fides.

It’s just to say that it seems pretty clear that while he was establishing Chainstarter (again, partially funded by a loan from 21 Million) and perhaps advising some of these projects, he mistakenly thought he could trust David Lofts to handle all of the 21 Million business, and didn’t keep an eye on him.

This is assuming, of course, that David actually did the things Nick is accusing him of. It would seem to rectify the contents of both letters. David claims Nick was not doing anything for 21 Million, Nick claims that David took advantage of project funds. The truth probably lies somewhere in the middle, but as they say “While the cat’s away, the mice do play.”

I hope that Nick Ayton has learned from his mistakes, because Chainstarter seems to be getting some serious investments from family offices in the UAE. But at the same time, he’s still working on his “passion project”, his version of 21 Million.

I, personally, find myself struggling to trust the judgement of someone who thought it was appropriate to loan investor funds from one business to another. I find myself questioning the perception of someone who didn’t notice until it was too late that his business partner was misusing company funds. I don’t question Nick’s dedication to and interest in the blockchain and cryptocurrency. But I don’t think he’s cut out for the position he’s placed himself in.

Nick Ayton and Chainstarter came to my attention due to a now-deleted post by Crypto Police, which was reposted by Paul Cliffe on LinkedIn. At Cointelligence, we can’t ignore scams, scam enablers, or corruption. Whenever we see it, we call it out. So I began to investigate further. Paul put me in touch with David Lofts, who provided me with his side of the 21 Million and Chainstarter story, as well as the two open letters shared below.

This is a complicated situation with a lot of blame being thrown around. I’ve decided not to take a side in the matter, and instead present you with the letters, and some further facts, and let you decide for yourself how to interpret the situation.

David Lofts accuses Nick Ayton of fraud

On April 2nd, 2018, after lengthy private correspondence, David Lofts published an open letter to Nick Ayton airing his grievances. The open letter can be a bit difficult to parse because it refers to a lot of previous private conversations, but the main accusations are:

- When the 21 Million Limited company and bank accounts were set up in May 2017, Nick Ayton and his wife Deborah were added as directors, and David was not added until December 2017.

- Nick and Deborah did not work on the 21M project or promote it, but instead used the company to fund other projects.

- Nick did not account for his use of 21M funds and actively hid records.

- Nick may have used 21M money to fund Chainstarter.

- Nick attempted to defraud David of his intellectual property (IP) related to the 21M project, including story and character names as well as digital assets such as the website and domain name.

- Nick did not recover tokens that were sent to the wrong exchange due to an error on David’s part.

- Nick and his son Obediah (Obe) participated in a pump-and-dump scheme with the 21M token, netting them approximately $130K, using tokens that should have remained vested.

To be clear, I am neither supporting or denying Mr. Lofts’ claims. Instead, I invite you to read his letter in its entirety, read Mr. Ayton’s follow up (summarized below and also provided in full), and draw your own conclusions.

Nick Ayton accuses David Lofts of fraud

On April 6th, 2018, Nick Ayton published his own open letter to David Lofts. He starts the letter by making some counter-accusations of his own, and you may see some similar themes in the accusations. His primary complaints:

- David had spent 25% of the investor money from 21M and had “nothing” to show for it.

- David’s claims against Nick were baseless and he had no evidence to back them up.

- Some very personal claims about David’s financial status at the start of the 21M project, including that Nick provided him with a personal loan.

- David and his wife used investor monies for personal purchases such as cars.

- David hired his friends for jobs on 21M, perhaps creating positions that were not even needed at the time.

- David refused to provide documentation of his expenditures.

- David decided to create a short film to submit to the Palm D’Or competition. Nick mentions the costs associated but it is unclear if he believes the money was taken directly from the 21M budget, or if he just believes it was an expensive distraction that took time and focus away from the 21M TV series.

- David did not actually write the content for 21M but took credit for other people’s work.

- David declared investor monies as personal income.

- David’s decision to contact investors with his concerns about Nick was damaging to the company.

This is followed by some attempts to address the complaints that David aired in his letter, including the serious accusations of a pump-and-dump, which you can see spelled out in the letter itself.

Again, I am neither supporting or denying Mr. Ayton’s claims.

This is a serious dispute that will ultimately have to be settled in court between Mr. Ayton and Mr. Lofts. The rest of us can only consider it as outside observers and draw our own conclusions while we wait for a legal ruling.

Who really owns 21 Million?

In the wake of David Lofts’ ouster from the 21 Million project, both David and Nick have continued to work on their own versions of the project.

They each maintain their own websites (Nick Ayton’s 21milliontv.com and David Lofts’ 21million.co.uk), and are each still using the 21 Million name. When you speak to either of them about it, you can tell that they are both passionate about it. However the ICO funds were managed (more on that below), both men clearly wanted to actually make this TV show.

So the question becomes, who does this project belong to? In their open letters, each accuses the other of IP theft.

At no point has Nick Ayton denied that 21 Million was originally David Lofts’ idea. What he has questioned was whether David had anything more than an idea and an in-progress novel. In his open letter, he accused David of taking credit for other people’s work, and Nick provided us with email from the screenwriter to back up this claim:

But this doesn’t answer the legal question of who owns the rights to the 21 Million name. It’s one thing to see two similar projects developed simultaneously (such as Netflix and Hulu’s dueling Fyre Festival documentaries, or those studios which specialize in cheap direct-to-video knock-offs of blockbuster films), but two projects with the same concept and the same name?

Does Nick Ayton have the right to continue to develop the project originally conceptualized by David Lofts? I actually don’t know, as I’m not privy to all of the details of whether the IP rights become property of The 21 Million Project when that company was formed, or whether they remained with David Lofts. That’s honestly between Nick and David, and I’m merely sharing it in case anyone with an interest in IP disputes wants to keep an eye on this to see what happens next, as this too may ultimately be decided in the court of law.

We have bigger things to talk about.

Misuse of investor funds

I reviewed a lot of emails and open letters and blog posts in the course of preparing this article, and there was one thing that both Mr. Ayton and Mr. Lofts can agree on: 21 Million made a loan of funds to Chainstarter, the ICO advisory company that Mr. Ayton and Mr. Lofts were also co-founders of.

WHAT?!?

Both men admit to this blatant misuse and misappropriation of investor funds from the 21M ICO.

The disagreement arises when it comes time to determine who authorized the loan. Mr. Ayton claims that he and Mr. Lofts both agreed to it. David Lofts denies this, stating that he never agreed to such a loan.

Regardless of who authorized it, I’d like us to all take a moment to think about this.

Chainstarter, a company which purports to advise ICOs and STOs on “Ethical Blockchain Funding”, was partially funded with a loan of funds from another company’s ICO. When I questioned Nick Ayton further about the loan, he insisted it was legal and paid back in full with interest:

It may be legal, but does it strike you as ethical?

To be clear, business-to-business loans aren’t that uncommon. But the issue here is two-fold. One, both businesses are owned by the same person. Two, these weren’t the business’s profits being loaned to another business with an expectation of earning interest on the investment. These were the investor funds which were intended to get the 21 Million project off the ground.

If you backed the 21 Million project, you did so with the intention of funding a TV show about a vast conspiracy related to cryptocurrency. Whether you did it because you thought it would be the Crypto DaVinci Code, or because you thought it was a sound investment that would offer a good return, that was what you intended to invest in. You were not investing your money so that 21M’s founders could then loan those funds to another project!

It might be tempting to say “Well, the money was paid back with interest, so it’s OK!” But that’s an “ends justifies the means” argument and ignores the possibility of the opposite happening. What if Chainstarter had crashed and burned? That would be 10k in investor money wasted on funding the founders’ unrelated other idea.

Chainstarter advises scams?

I have spoken with David Lofts, and he has told me that during his time at Chainstarter, it took a majority decision to agree to take on a client. He objected to several projects on the suspicion that they were either deliberate scams or just poorly-thought out. These included:

- Envion (apparent scam)

- Munchee (poorly conceived)

- CryptoMillions (apparent scam)

David alleges that Chainstarter opted to work with these clients against his objections. Envion has since gone into bankruptcy liquidation and was found guilty by FINMA of violating supervisory law, after their in-house counsel took off with some of the funds.

Chainstarter denies having worked with Envion or CryptoMillions. However, they do agree that they provided technology for Munchee, which went on to become one of the first ICOs shut down by the SEC. But they followed that up by saying they also called them out for their lies, and they appear to agree that the SEC was right in shutting them down.

This article by Andrew J. Chapin, who served as an advisor for Munchee, shows how the project went from something that seemed viable if not particularly groundbreaking, to being in clear violation of securities regulations.

In absence of any proof that Chainstarter did work with Envion or CryptoMillions, I don’t think a strong argument can be made for Chainstarter having a history of working with scams.

The issue of mismanagement

So if there’s no clear evidence of Chainstarter’s involvement with scams, and if the loan from 21 Million to Chainstarter was technically legal, why do I still have such a bad feeling about Chainstarter?

The thing is, even if Nick Ayton is truly dedicated to providing advice and technology for crypto projects to launch with full regulatory compliance, I don’t think I trust his judgment or his management skills.

He accuses David Lofts of all manner of misuse of company funds, and of not achieving much with the time and money he was given.

This strikes me as a gross case of mismanagement. And I don’t think Nick was being willfully negligent here. I don’t think he didn’t care what was happening with 21 Million funds, because I do think he thought the project was a great idea.

I think he made a mistake that I see happening over and over again in the crypto industry: he is overcommitted. Instead of choosing one thing and doing it well, he’s doing 20 things poorly, and missing the fact that his own business partner was spending investor funds on cars or what-have-you.

Let’s look at a signature from an old email that Nick forwarded to me:

Founder of several projects and CEO of one, author at two different sites, advisor on one fund, and board advisor on NINE projects. That’s a lot of plates to keep spinning at once.

That’s not to say that Nick was definitely actively advising all of those ICOs at once -- some of them could have been past projects that he was still proud of and sharing in his signature to establish his bona fides.

It’s just to say that it seems pretty clear that while he was establishing Chainstarter (again, partially funded by a loan from 21 Million) and perhaps advising some of these projects, he mistakenly thought he could trust David Lofts to handle all of the 21 Million business, and didn’t keep an eye on him.

This is assuming, of course, that David actually did the things Nick is accusing him of. It would seem to rectify the contents of both letters. David claims Nick was not doing anything for 21 Million, Nick claims that David took advantage of project funds. The truth probably lies somewhere in the middle, but as they say “While the cat’s away, the mice do play.”

I hope that Nick Ayton has learned from his mistakes, because Chainstarter seems to be getting some serious investments from family offices in the UAE. But at the same time, he’s still working on his “passion project”, his version of 21 Million.

I, personally, find myself struggling to trust the judgement of someone who thought it was appropriate to loan investor funds from one business to another. I find myself questioning the perception of someone who didn’t notice until it was too late that his business partner was misusing company funds. I don’t question Nick’s dedication to and interest in the blockchain and cryptocurrency. But I don’t think he’s cut out for the position he’s placed himself in.